The warnings have come, the regulations have been issued,

and EVS

has given advice on how to pass the first test, but how many institutions

understand the FFIEC update? As weve discussed in many of our blogs, the newly

updated set of FFIEC

compliance regulations can be confusing to understand especially because

they are applied in very different ways varying on the company. In a study

conducted by Bank

Info Security, they discuss the three main improvements needed to better

address todays online

banking risks.

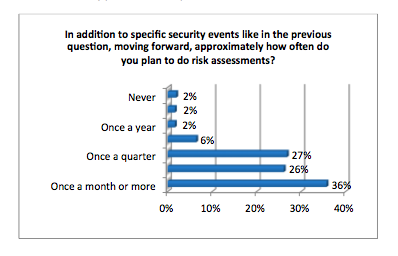

The first area of improvement is risk assessments. Companies

were free to conduct risk assessment as often or as seldom as they felt necessary. This freedom left room for companies

to neglect the ever-growing online

ID theft dangers. The new regulations now make it mandatory for companies

to conduct a risk assessment at least once a month. In response to this new

requirement, companies have committed to doing more evaluations outside of the new

guidelines.

Source: FFIEC Online Banking Security

Readiness Study-Guardian Analytics

The second improvement is with layered

security. Retail and business

accounts are expected to have the ability to detect any suspicious activity

upon logging into an account, at the very least. The FFIEC wants additional

security for business accounts and hopes that the increased amounts of risk

assessments will help detect the need for added layers. ID

authentication can help add to these extra layers that the agencies

suggest. The final area of improvement is in Customer/Member education. This is a very important step that many

companies have over looked in years past. Letting your customers and/or clients

know the measures youre taking to protect them, can make a significant

difference in fraud

prevention efforts. The requirements now include explaining your protection

measures, how the company will contact their customers if there is an issue,

how customers can protect themselves, and how and when it is appropriate to

contact the institution.

The FFIEC Compliance regulations go into much more depth

that just these three areas of improvement. Contact EVS

today for more information and for help complying.